Life doesn’t always wait for payday. When unexpected expenses pop up—like a car repair or medical bill—having access to funds quickly can make all the difference. Modern financial solutions have evolved to meet these urgent needs, offering streamlined processes that prioritize both speed and simplicity.

Gone are the days of lengthy paperwork and endless waiting. Many lenders now provide online tools that let you apply from home, with decisions often made in minutes. Services like Check ’n Go, for example, combine fast approvals with fixed interest rates and predictable payment plans, giving you clarity while managing your budget.

These options aren’t just about speed. They’re designed to help you stay in control during stressful times. Whether covering a short-term gap or handling an emergency, understanding your choices ensures you can act confidently when it matters most.

Key Takeaways

- Quick access to funds helps address urgent financial needs without delays.

- Online applications simplify the process, letting you apply securely from anywhere.

- Fixed rates and clear payment plans prevent surprises down the road.

- Tools from trusted lenders prioritize transparency and ease of use.

- Knowing your options empowers smarter decisions during emergencies.

What Are Instant Loans?

When time is of the essence, traditional funding methods may fall short. Modern financial tools bridge this gap by offering rapid responses to urgent cash needs. Let’s explore how these products work and when they’re most effective.

Defining Quick Cash Access

Short-term funding is designed for emergencies requiring immediate action. Most applications are reviewed within hours, and funds often arrive the same day. Unlike conventional bank products, these solutions prioritize speed over lengthy approval processes.

Common Uses and Benefits

People typically use these funds for:

- Medical bills not covered by insurance

- Critical home or vehicle repairs

- Essential utility payments

Clear repayment schedules help borrowers plan effectively. Many lenders provide fixed fees rather than compounding interest, creating predictable budgeting scenarios.

| Feature | Traditional Bank Product | Short-Term Solution |

|---|---|---|

| Approval Time | 3–7 business days | 1–24 hours |

| Repayment Period | 12–60 months | 2 weeks–6 months |

| Credit Check | Strict requirements | Flexible options |

Financial experts emphasize using these tools judiciously. The Consumer Financial Protection Bureau notes: “Short repayment windows help prevent long-term debt cycles when used as intended.”

Benefits of Using Instant Loans

Financial emergencies don’t follow schedules. Modern financial tools address this reality by combining speed with user-friendly features. Let’s explore how these services stand out when you need reliable support.

Fast Funds with Quick Approval

Speed matters when bills pile up. Many providers now offer decisions within minutes of submitting your application. Check ’n Go, for example, can transfer funds to a Visa debit card in under 30 minutes. This efficiency helps you tackle urgent needs without waiting days for bank transfers.

Predictable Payments and Fixed Interest Rates

Budgeting becomes simpler with fixed costs. Unlike credit cards, which often have variable rates, these solutions lock in your interest upfront. You’ll know exactly what you owe each month—no guessing or hidden fees.

| Feature | Credit Cards | Quick Cash Solutions |

|---|---|---|

| Rate Type | Variable | Fixed |

| Payment Clarity | Monthly changes | Same amount every cycle |

| Funding Speed | 3–5 business days | As fast as 30 minutes |

The Personal Touch and Customer Support

Real help makes a difference. Dedicated teams guide you through applications and answer questions. One user shared: “The agent stayed on the phone until I understood every step—it felt like talking to a friend.” This human connection reduces stress during tight deadlines.

Whether covering car repairs or medical bills, these tools provide both speed and stability. Clear terms and professional support turn chaotic moments into manageable plans.

How the Instant Loans Process Works

Digital tools have transformed how we handle unexpected expenses. The journey from application to funds in your account is now faster than ever, with clear steps designed for simplicity.

Simple Online Application

Start by completing a secure digital form. You’ll share basic details like income and contact information. Most people finish in under 5 minutes using their smartphone or computer.

Your checking account must be active for 30+ days. This requirement helps lenders confirm your financial stability. Approval decisions typically come within moments of submission.

Fast Funding Methods and Timing

Once approved, choose your preferred transfer method:

| Funding Method | Speed | Requirements |

|---|---|---|

| Visa Debit Card | 30 minutes | Card in your name |

| ACH Transfer | Same day* | Valid routing number |

*Timing depends on your bank’s processing schedule

Visa cardholders often see funds fastest. ACH transfers work well for those needing direct bank deposits. Either way, most requests complete within 24 hours.

Track your progress through user-friendly dashboards. Automated updates keep you informed at every stage—no branch visits required.

Qualifying for Instant Loans in the United States

Navigating financial requirements can feel overwhelming during emergencies. Understanding eligibility rules helps streamline the process while meeting local regulations.

Eligibility Criteria for Residents

Basic requirements focus on stability and responsibility. Most providers ask applicants to:

| Requirement | Traditional Lenders | Quick Cash Solutions |

|---|---|---|

| Minimum Age | 21+ | 18+ |

| Income Proof | Tax documents | Recent pay stubs |

| Bank History | 6+ months | 30+ days active |

Providers like Check ’n Go review applications using national databases. This helps verify identity while respecting privacy standards.

State-Specific Rules That Matter

Regulations differ significantly across state lines. For example:

- Indiana caps payday amounts at $825

- Texas allows flexible repayment timelines

- California prohibits rollover fees

Financial advisor Jane Porter notes: “Always check your state’s website for updated guidelines—they change more often than people realize.”

| State | Max Amount | Term Limits |

|---|---|---|

| Indiana | $825 | 31 days |

| Texas | Varies | 180 days |

| California | $300 | 31 days |

Residents in 13 states can currently apply online. Always confirm availability through official lender portals before starting your application.

Understanding Rates, Terms, and Fees

Financial clarity starts with knowing the numbers. Before committing to any agreement, reviewing the fine print helps avoid confusion later. Modern providers prioritize transparency, ensuring you see all costs upfront—from interest percentages to processing fees.

Competitive Loan Rates and Terms

Fixed interest rates lock in your costs from day one. Unlike variable options, these stay consistent throughout repayment. For example:

| Rate Type | Average Range | Flexibility |

|---|---|---|

| Fixed | 5–35% | No changes |

| Variable | 4–29% | Monthly shifts |

Terms typically span 3–24 months, with payments split into manageable installments. As financial advisor Mark Torres notes: “Predictable schedules let borrowers focus on priorities instead of payment surprises.”

Administration Fees and Additional Costs

Most providers charge a one-time processing fee up to 9.99%. This covers application reviews and account management. State laws often cap these charges—California limits them to 5% for certain products.

Always review your agreement for:

- Prepayment penalties

- Late payment fees

- Documentation charges

These details appear clearly in initial disclosures. Comparing multiple offers helps identify the most cost-effective solution for your budget.

Loan Options for Various Financial Needs

Choosing the right financial tool can turn overwhelming situations into manageable plans. Whether addressing sudden bills or funding long-term goals, modern solutions adapt to your unique circumstances.

Personal Loans vs. Payday Loans

A personal loan often works best for larger expenses needing extended repayment. These typically offer terms from 12–60 months with fixed rates. Payday alternatives, however, focus on immediate cash needs with shorter timelines—usually 2–4 weeks.

| Feature | Personal Loan | Payday Option |

|---|---|---|

| Amount Range | $1,000–$50,000 | $100–$1,000 |

| Repayment Period | 1–5 years | Next paycheck |

| Interest Type | Fixed | Single fee |

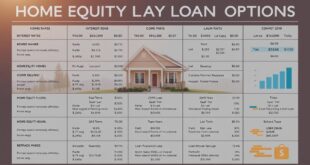

Consolidation and Home Improvement Options

Debt consolidation simplifies multiple payments into one monthly plan. This strategy often lowers overall interest costs. As financial coach Lisa Yang explains: “Combining credit card balances can cut stress and save hundreds annually.”

For homeowners, improvement-focused products help upgrade living spaces. These funds might cover:

- Kitchen remodels

- Energy-efficient windows

- Emergency roof repairs

Specialized options consider your project scope and home equity. Always compare terms to find the best fit for your timeline and budget.

Customer Success Stories and Testimonials

Trust grows when others share their positive experiences. Thousands have found relief through modern financial services—here’s how real people transformed stressful situations into success stories.

Real People, Real Success

Bullockdetra sums up their experience: “The entire process took two hours—from application to funds in my account.” This efficiency helps families handle car repairs or medical bills without delays.

Kurtis highlights long-term trust: “They never disappoint, whether managing home mortgages or personal needs.” With a 4.9/5 satisfaction rating, users consistently praise:

- Clear communication at every step

- Responsive customer support teams

- Flexible solutions for unique situations

| Feature | First-Time Users | Repeat Customers |

|---|---|---|

| Approval Speed | 2–4 hours | Under 90 minutes |

| Exclusive Discounts | — | Up to 15% rate reduction |

| Priority Support Access | Standard | 24/7 dedicated line |

Loyalty Discounts and Repeat Benefits

Calan T. saved significantly through relationship-based perks: “Our existing home mortgage unlocked the lowest available rate.” Many providers reward returning clients with:

Consolidation success stories show how combining debts into single payments helps people regain control. One user shared: “I cut three credit card payments into one manageable plan—it simplified everything.”

These experiences build lasting connections. As needs evolve—from emergency repairs to home upgrades—consistent service quality keeps customers coming back.

Technology & Tools for Effortless Loan Management

Managing financial obligations has become simpler with today’s digital solutions. Platforms like Check ’n Go combine intuitive design with powerful features to help users stay organized. These tools eliminate paperwork while keeping your data secure and accessible.

Easy-to-Use Online Application Tools

Modern platforms guide you through each step with clear instructions. You’ll enter basic information once—the system auto-fills future forms to save time. Most applications take under 10 minutes, with error-checking features that flag missing details before submission.

| Feature | Traditional Methods | Modern Tools |

|---|---|---|

| Application Time | 45+ minutes | Under 10 minutes |

| Payment Options | Manual checks | Auto-pay scheduling |

| Account Access | Phone calls required | 24/7 mobile dashboard |

Auto-pay setups prevent missed payments by deducting funds automatically. One user shared: “I set up recurring payments during application—now I never worry about due dates.” Real-time updates show your remaining balance and next payment amount instantly.

Advanced encryption protects your personal information throughout the process. Customizable alerts notify you about upcoming deadlines or account changes. These innovations turn complex tasks into seamless routines, letting you focus on what matters most.

Instant Loans: Your Fast Track to Quick Cash

When urgent expenses arise, traditional banking delays can leave you stranded. Modern financial services bridge this gap with tailored options that adapt to your timeline and budget. Let’s explore how flexible solutions and rapid approvals create new possibilities for money management.

Customized Solutions for Every Situation

Approval processes now take minutes instead of days. Many providers offer decisions while you wait, with funds arriving in under an hour. This speed helps thousands handle emergencies like:

- Last-minute medical bills

- Critical home repairs

- Unexpected travel costs

| Feature | Traditional Banks | Modern Options |

|---|---|---|

| Max Amount | $5,000 | $50,000 |

| Credit Checks | Hard inquiry | Soft pull available |

| Specialized Options | Limited | Debt consolidation, home upgrades |

Financial advisor Rachel Nguyen explains: “Borrowers appreciate seeing multiple offers side-by-side. It helps them choose terms that align with their paycheck cycles.”

Homeowners benefit from solutions addressing roof leaks or HVAC failures. Debt consolidation packages combine existing balances into single payments, often with rate discounts. Credit history rarely blocks approval—many lenders focus on current income instead.

With options ranging from $500 to $50,000, these services help thousands regain control weekly. Digital tools let you compare offers today and select the best fit for your situation.

Conclusion

Financial surprises test our readiness, but modern solutions help you respond with confidence. Today’s tools blend speed with thoughtful design—letting you address car repairs or medical bills without derailing your budget.

Trusted providers simplify emergency funding through clear terms and digital convenience. Many offer same-day transfers and fixed rates that keep payments predictable. This combination helps you focus on solutions rather than financial stress.

Always compare options to find terms matching your timeline. Check state regulations first, as rules vary widely. With transparency and smart planning, temporary challenges become manageable stepping stones.

Modern tools empower better decisions when it matters most. Whether handling unexpected costs or planning ahead, these resources put control back in your hands—one informed choice at a time.

Website Teknologi Terupdate

Website Teknologi Terupdate